The Investment Impact Index™ (III™) is proudly developed and brought to you by Next Generation. 15 years assisting great clients, including these and many more.

Features

Methodology

Created by Next Generation, the Investment Impact Index™ (III™) is an integrated impact measurement and management solution

Discover

Technology

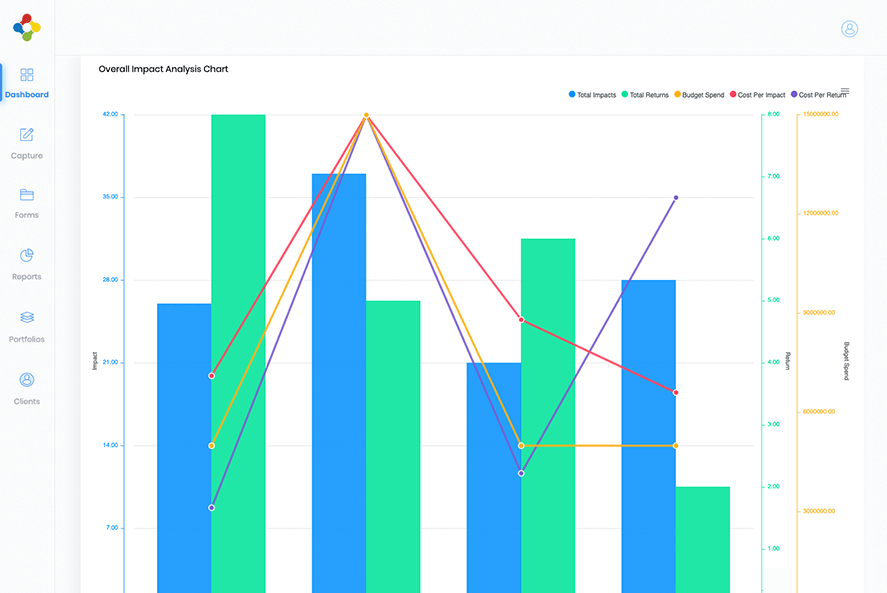

Our simple and powerful online application is a valuable tool for your effective impact measuring, managing and reporting challenges.

View

Resources

Take advantage of our valuable resources that range from articles, training and short guides, to presentations and videos.

Browse

Want updates and information? Sign up now.

Powerful and simple

Watch this short video from Next Generation and Investment Impact Index™ (III™) founder Reana Rossouw as she guides you through the metholodology and interface of our powerful online reporting platform.